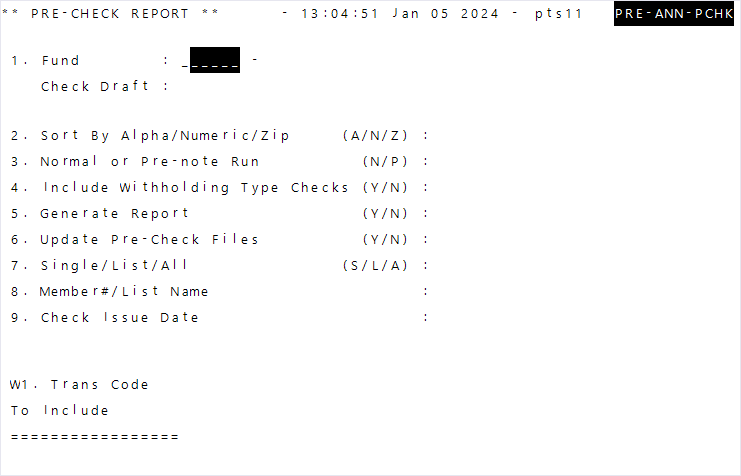

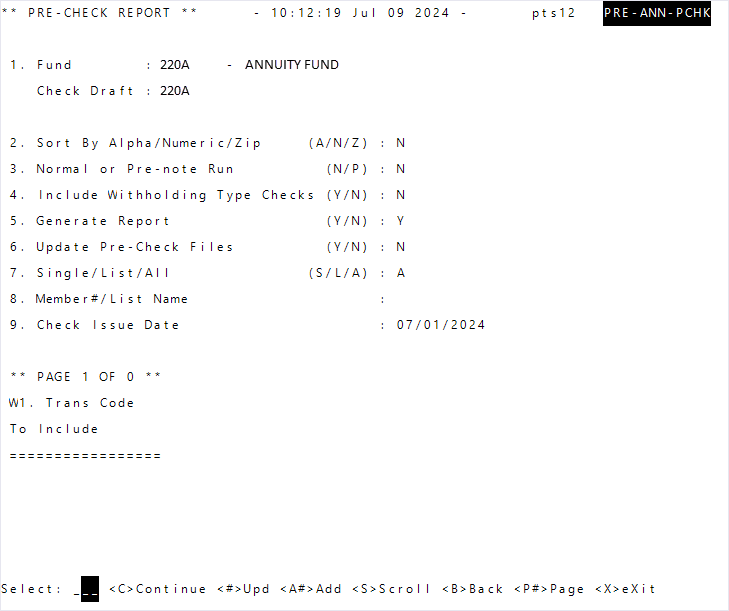

Step 1—Create a pre-check report

Use the Pre-Check report to create a check run for verification and printing. If you’re using the Pending Batch Payment Maintenance process, complete them before the Pre-Check.

Go to:Home > Displays, Data Preps, Reports > Annuity > Pre-Check Report

* indicates a required field

| Field | Description |

|---|---|

Fund (or ALL)* |

The fund included in the pre-check. The fund description will display upon entering the fund ID. Enter |

| Check Draft* | Displays the check draft associated with the fund. |

| Sort By Alpha/Numeric/Zip (A/N/Z)* |

Determines the pre-check sort order.

|

| Normal or Pre-note (N/P)* |

Determines the check run type.

|

| Include Withholding Type Checks (Y/N)* |

Determines if withholding checks are included in the pre-check. This field is only valid if your organization has withholding members set up and you want the check run to issue checks to the agency (IRS, State, Child Services, etc.).

|

| Generate Report (Y/N)* |

Determines if a pre-check report generates.

|

| Update Pre-Check Files (Y/N)* |

Determines if files are updated to create a check run for verification.

|

| Single/List/All (S/L/A)* |

Determines who is included in the check run.

|

| Member #/List Name | The member (SSN) or list name to generate the pre-check on if you selected S or L for the previous field. Enter in Fund*SSN format. |

| Check Issue Date |

The check draft associated with the fund. The appropriate draft is entered by default. This date is required when GAP SAC <42> |

| W1. Trans Code To Include |

Determines the transaction types to include (or exclude) in the pre-check. Leave this blank to include all transaction codes. Hint: Enter |

- Enter the

Fundto run the pre-check. -

Enter the pre-check report criteria. Messages might display as you enter information.

Important! You need to generate this report twice. First, run the report without updating the files (enterNfor field 6). Check the first report, and make adjustments until it displays the correct information. Once you've ensured that the information is accurate, run the report again and update the files (enterYfor field 6). - Select

Cto run and create the report. - Find your report and review the results.

- Continue to Step 2—Verify the pre-check.

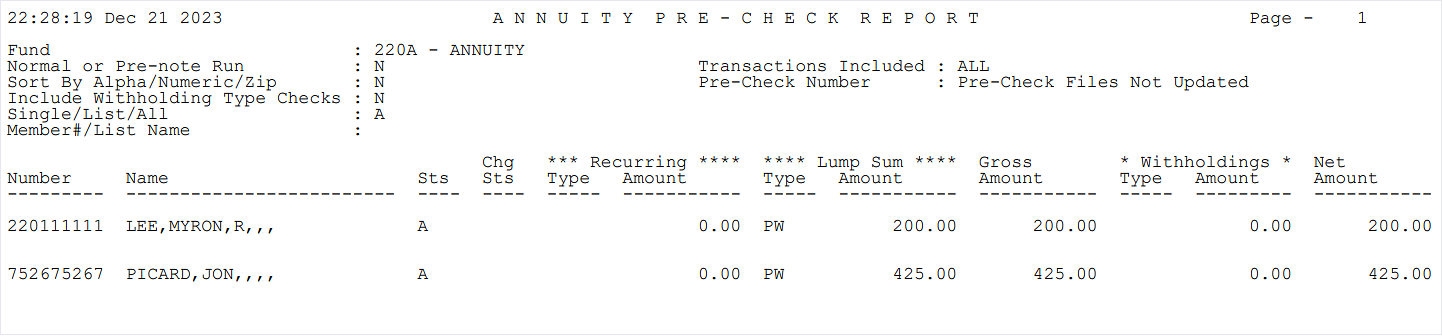

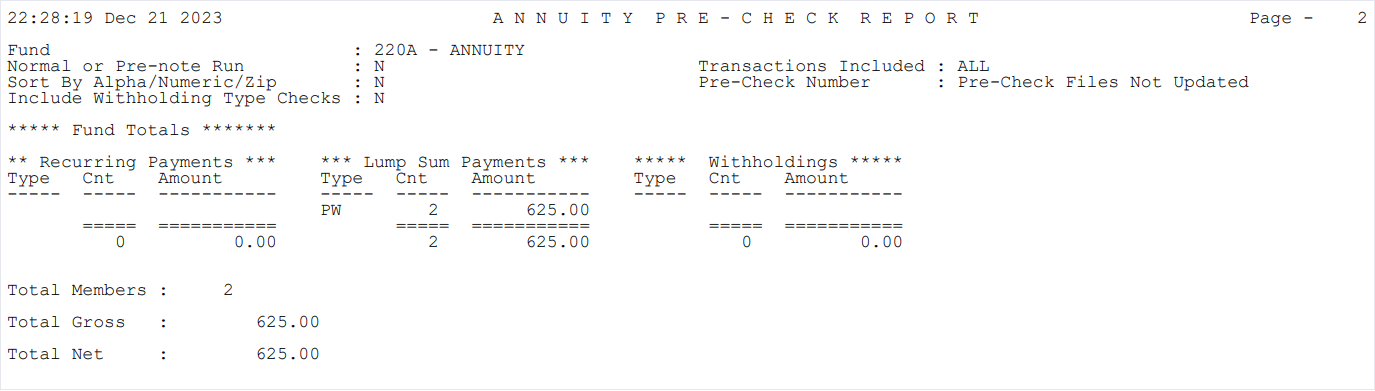

| Field | Description |

|---|---|

| Report Heading | |

| Fund |

The name of the fund. |

| Normal or Pre-note Run | The run type selected. |

| Sort By Alpha/Numeric/Zip | The sorting order selected. |

| Include Withholding Type Checks | Displays whether withholding type checks are included in the report. |

| Single/List/All | The entity for which you ran the report. |

| Member#/List Name | The member number or list name entered. |

| Transactions Included | Displays the transaction codes included in the report. |

| Pre-Check Number (if files are updated) | Displays the pre-check run number, if applicable. |

| Report Body | |

| Number | The member number (SSN or SIN). |

| Name | The member’s name. |

| Sts | The payment status. |

| Chg Sts | The change to status. For a prenote run, this field displays the new direct deposit payment status that’s assigned when the prenote is completed. For a normal run, this field is only used if the member’s check amount is reduced to avoid disbursing more than the annuity balance. These changes to statuses are specified in Add and Update Status Codes. For prenotes, it’s the status set up in the Change-To Status Code field. For normal check runs, it’s the status set up in the Adj Change-To Status Code field. |

| Recurring Type | The recurring type. |

| Recurring Amount | The recurring amount. |

| Lump Sum Type | The lump sum type. |

| Lump Sum Amount | The lump sum amount. |

| Gross Amount | The gross amount. |

| Withholdings Type | The withholdings amount. |

| Withholdings Amount | The withholdings amount. |

| Net Amount | The net amount. |